tax credit survey mean

Thats what tax pros mean when they say tax credits are a. A tax credit property is an apartment complex or housing project owned by a developer or landlord who participates in the federal low-income housing tax credit LIHTC program.

Work Opportunity Tax Credit What Is Wotc Adp

The Child and Dependent Care Credit effectively reimburses you for some of what you must pay to a care provider to watch your children or your disabled dependents while you work or look for work.

. The tax credit for target group I long-term family assistance recipient is 40 percent of first year qualified wages up to 10000 and 50 percent of second year qualified wages up to 10000. The credit is based on the category of workers the wages paid to them in their first year of work and the hours they work. A survey by End Child Poverty estimated that roughly 15 million parents have reduced.

There are two 80 sub-all rules to consider with the research tax credit. However if you have a 100 tax credit it will save you 100 in taxes. A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit.

The Work Opportunity Tax Credit WOTC can help you get a job. I earned about 800 this year doing online surveys and in-home testing for market research and was wondering if these count toward the Earned Income Tax Credit. You can possibly claim a credit equally to 26 percent of an employee.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have. As of 2020 most target groups have a maximum credit of 2400 per eligible new hire but some may be higher. Of the government-funded hiring incentives the one with the highest visibility is Work.

In certain circumstances you may be able to claim either the 40 percent of 6000 tax. Research Tax Credit Sub-All Rules. All income generated by taking online surveys should be reported on your income taxes.

Land survey if they do one would be listed in the closing document as an expense. To present your job-related skills and qualifications. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and total qualified wages paid.

For example if youre the 22 tax bracket and you have a 100 deduction that deduction will save you 22 in taxes 22 of 100. A company hiring these seasonal workers receives a tax credit of 1200 per worker. Noun an amount of money that is subtracted from taxes owed.

A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. An employer must first get a determination of eligibility from their. When 80 or more of an employees wages qualify as research expenditures 100 of his or her wages can be claimed.

The individual must be retained at least 180 days or 400 hours. Similarly when 80 or more of a projects costs qualify 100 of the projects expenditures can be claimed as QREs. Claim all income and prizes.

The Work Opportunity Tax Credit program gives employers an incentive to hire individuals in targeted groups who have significant barriers to employment. Knowledgeable enough or properly equipped to file for credits or to file for them effectively enough to maximize whats available to them. A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. We request that you complete the following survey to determine if our company may be eligible for tax credits based on our hiring practices. Voluntary questionnaires dont solicit information about job-related qualifications and therefore are not a disqualifying factor in hiring.

Your application cover letter and resume fulfill one important purpose. Credits are generally designed to encourage or reward certain types of behavior that are considered beneficial to the economy the environment or to further any other purpose the. A tax credit is a type of tax incentive that can reduce the amount of money a taxpayer owes the government.

Deductions reduce your taxable income while credits lower your tax liability. Opportunity Tax Credit WOTC the flagship federal program jointly managed by the IRS and Department of Labor. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment.

Factors such as education work experience technical skills aptitude and. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. It is not done on all sales as the lots are generally plotted already and there is no need for it most of the time.

Unlike a tax deduction which reduces taxable income a taxpayer can subtract a tax. The value of a tax credit depends on the nature of the credit. A tax credit is an amount of money that taxpayers are permitted to subtract from taxes owed to their government.

EMPLOYER WILL NOT SEE YOUR RESPONSES. Chief Executive of charity Turn2us commented Todays vote in the House of Commons will mean one thing for many of the poorest working. Tax credits reduce the amount of income tax you owe to the federal and state governments.

Parcels outside of town it is more common. Hiring certain qualified veterans for instance may result in a credit of. For the 2021 tax year the credit was temporarily expanded to up to 8000 in costs for two or more children or 4000 if.

Tax credit questions become part of the application and applicants view the extra 30 seconds to two minutes that are required to complete the hiring incentive questions as just another step in. As well you should also be claiming the cash value of gift certificates and other prizes you receive. This tax credit is for a period of six months but it can be for up to 40.

Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC. This tax credit may give the employer the incentive to hire you for the job. The Child and Dependent Care Credit.

Keep check stubs on file and keep track of any PayPal payments you receive in case of an audit. These are the target groups of job seekers who can qualify an.

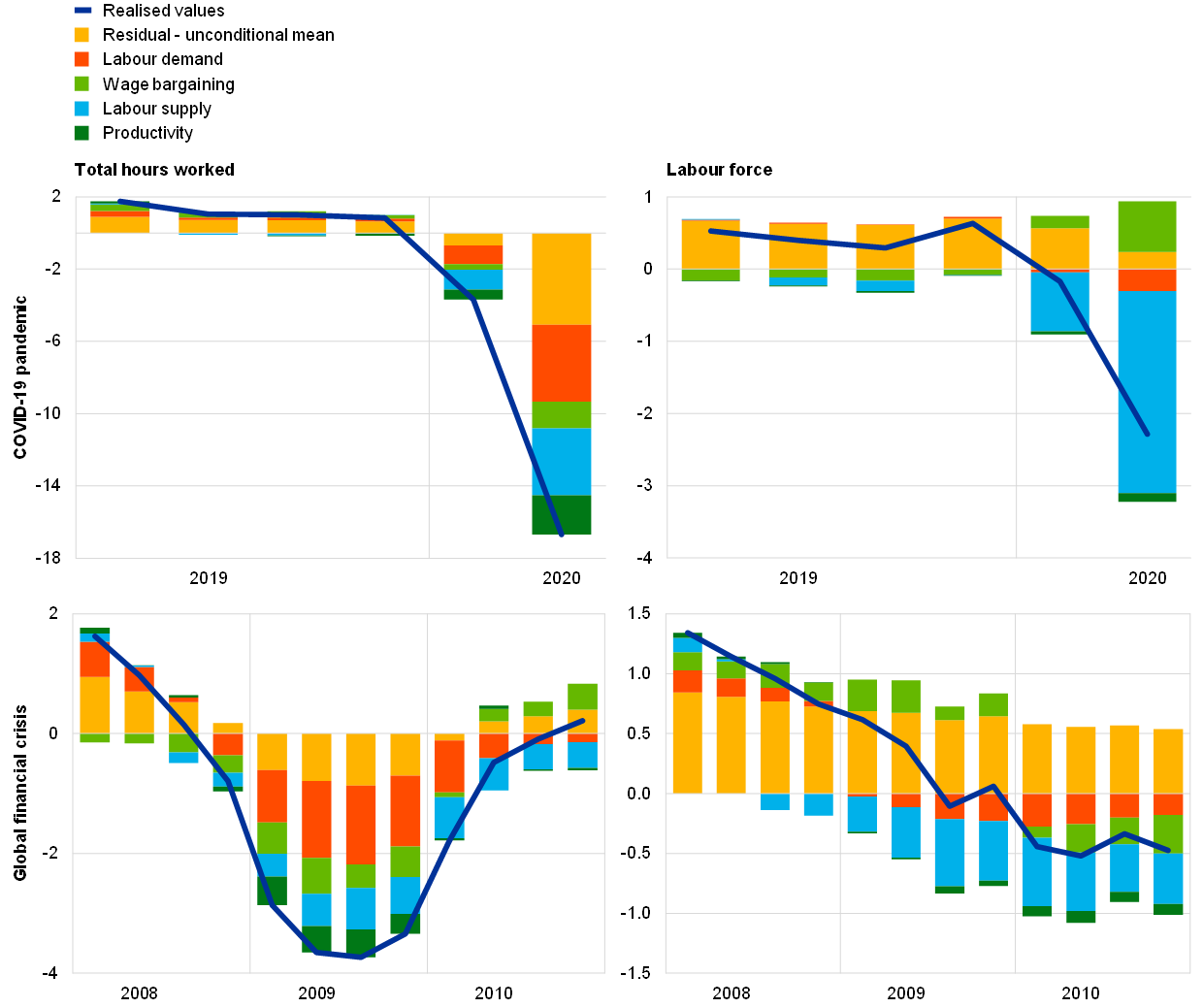

The Impact Of The Covid 19 Pandemic On The Euro Area Labour Market

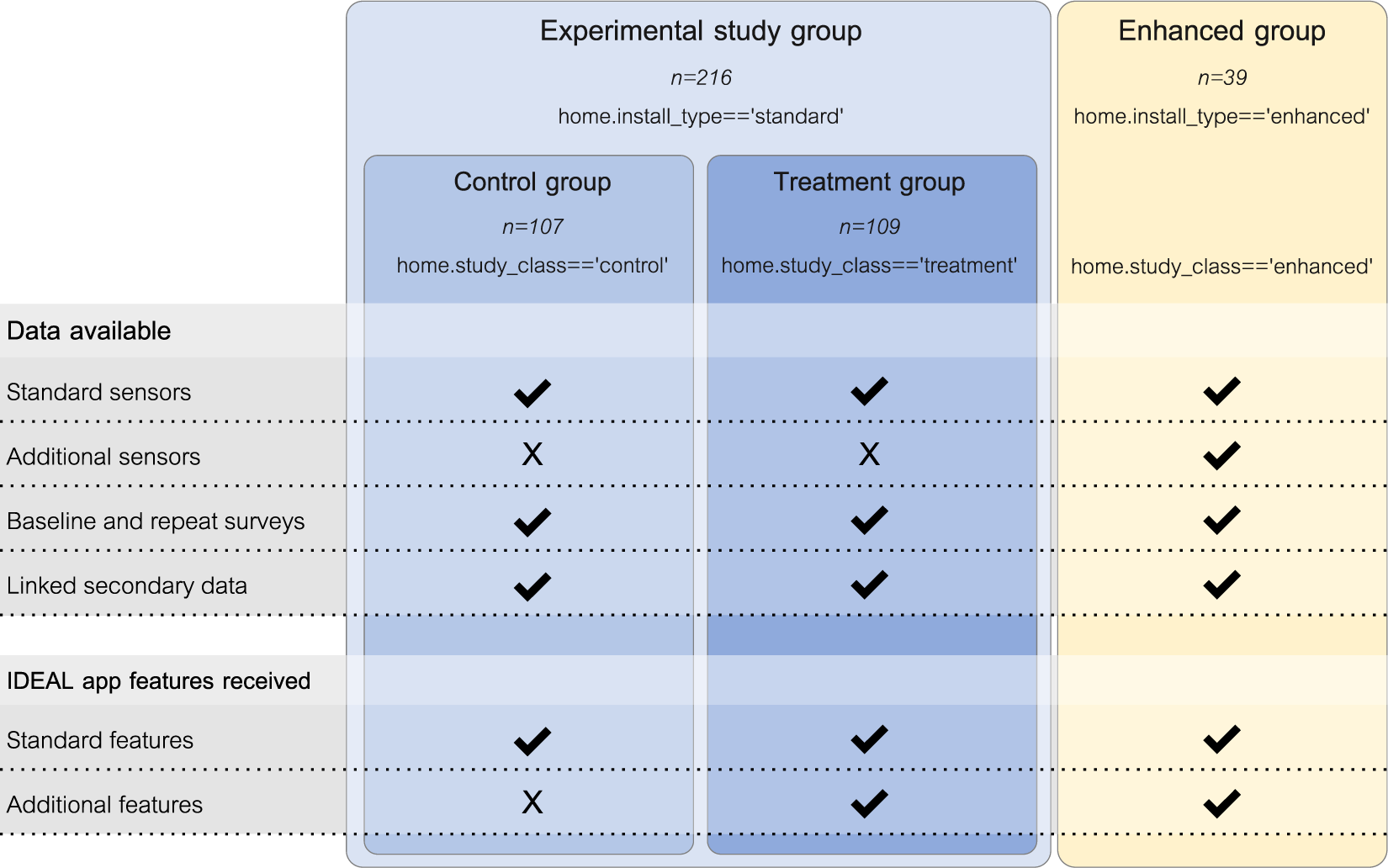

The Ideal Household Energy Dataset Electricity Gas Contextual Sensor Data And Survey Data For 255 Uk Homes Scientific Data

Reports Climate Bonds Initiative

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Work Opportunity Tax Credit What Is Wotc Adp

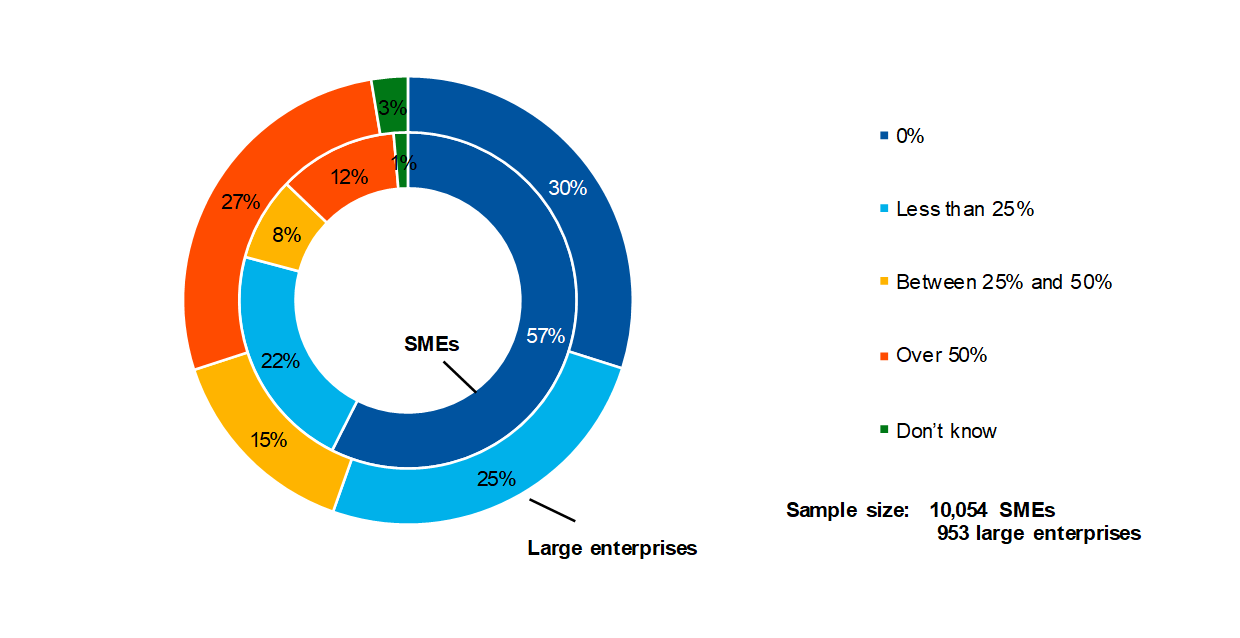

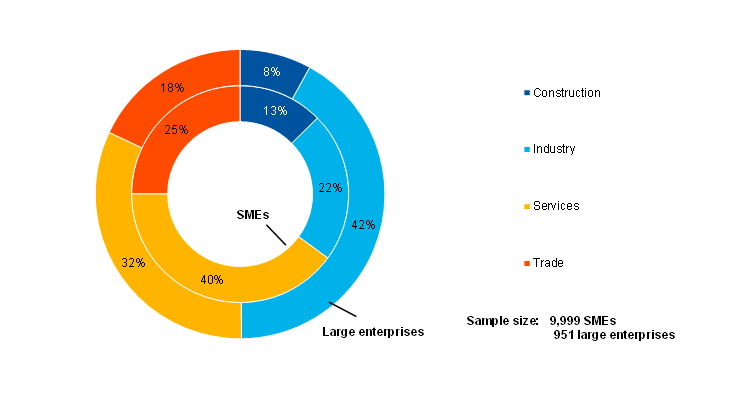

Survey On The Access To Finance Of Enterprises In The Euro Area October 2020 To March 2021

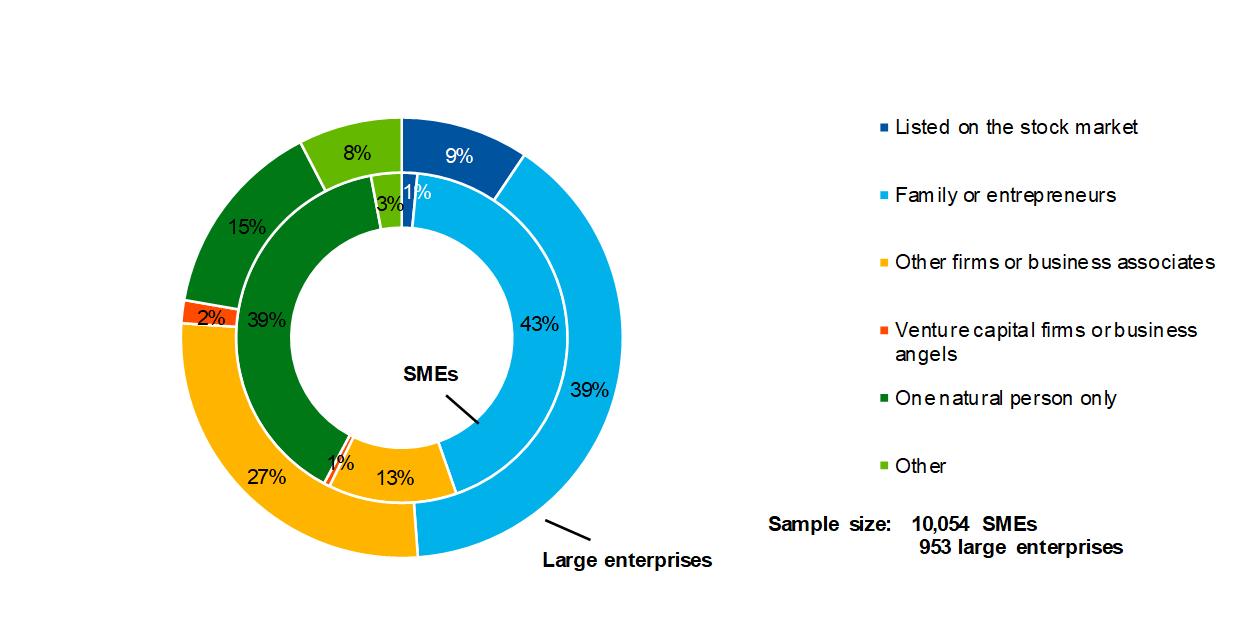

Survey On The Access To Finance Of Enterprises In The Euro Area October 2020 To March 2021

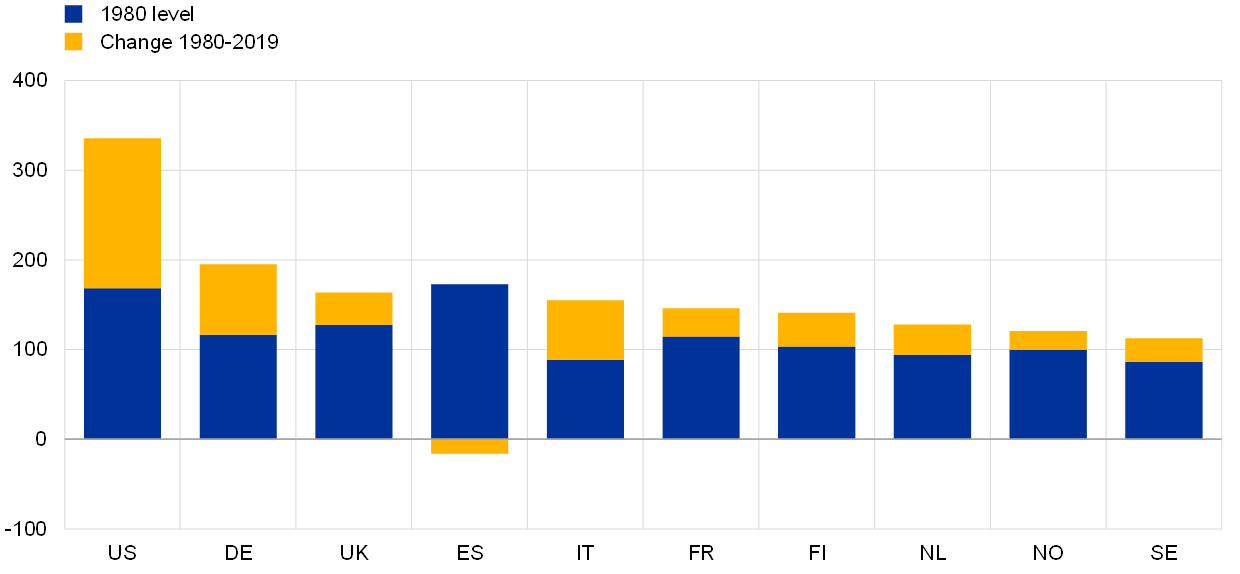

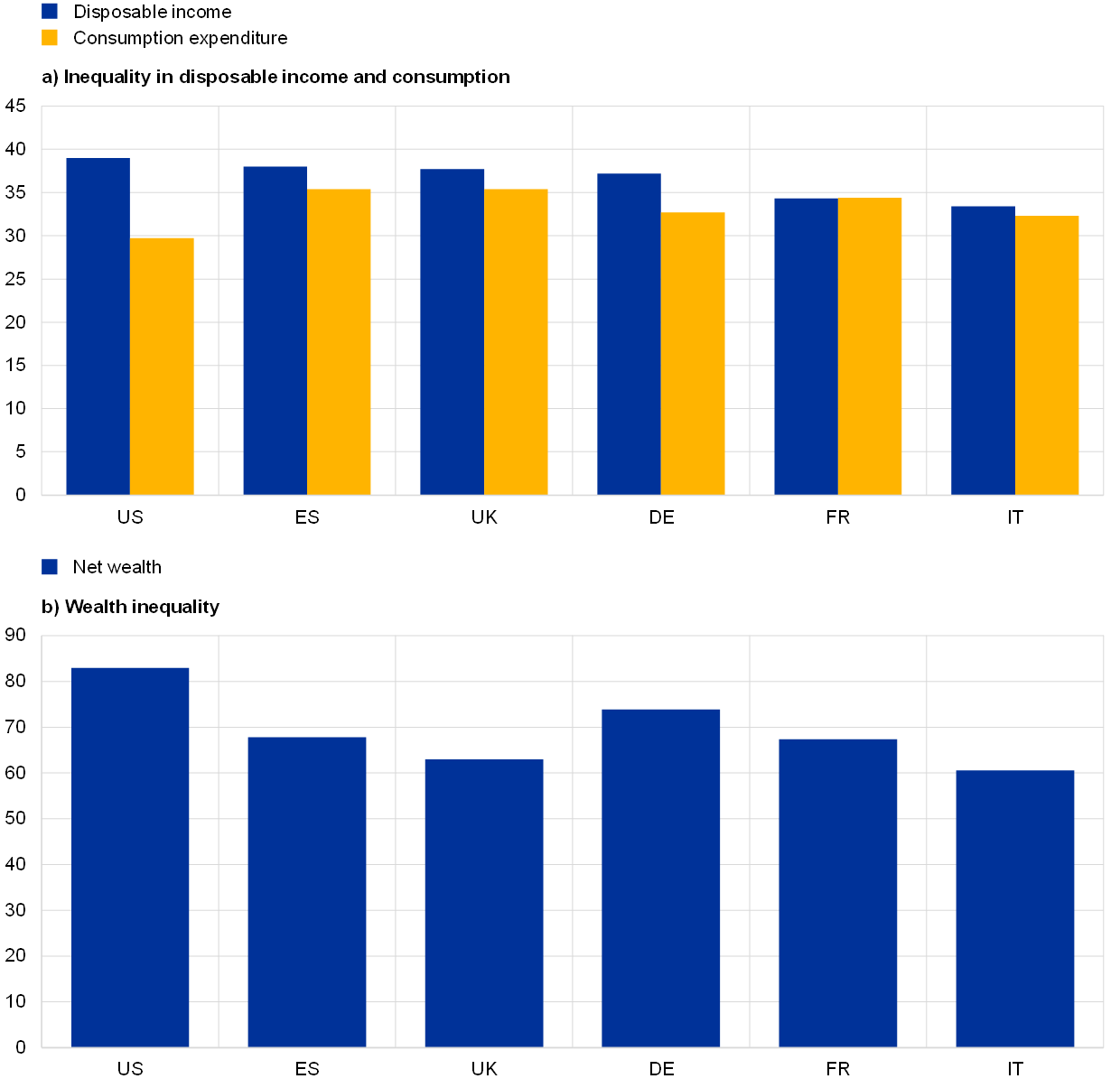

Monetary Policy And Inequality

Reports Climate Bonds Initiative

Monetary Policy And Inequality

What German Households Pay For Power Clean Energy Wire

Why It Matters In Paying Taxes Doing Business World Bank Group

Survey On The Access To Finance Of Enterprises In The Euro Area October 2020 To March 2021

Why It Matters In Paying Taxes Doing Business World Bank Group

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Closing Costs That Are And Aren T Tax Deductible Lendingtree

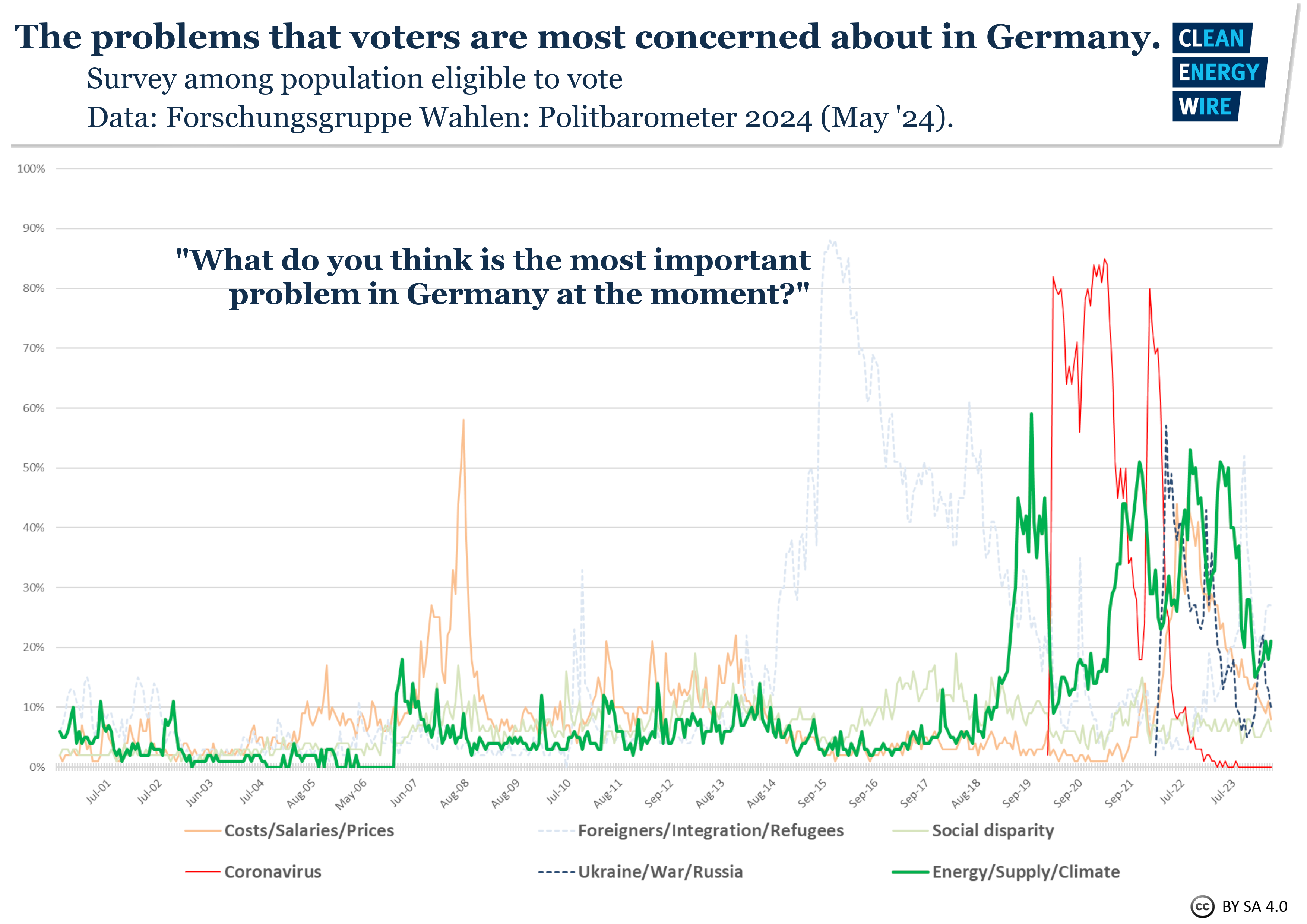

Polls Reveal Citizens Support For Climate Action And Energy Transition Clean Energy Wire